I have a new (intellectual) crush: Stanley Druckenmiller. If you don’t share my feelings, you will after you read his Jan 2015 speech at the Lost Tree Club. Portfolio management related excerpts below:

Diversification, Sizing

“I think diversification and all the stuff they're teaching at business school today is probably the most misguided concept...And if you look at all the great investors that are as different as Warren Buffett, Carl Icahn, Ken Langone, they tend to be very, very concentrated bets. They see something, they bet it, and they bet the ranch on it. And that's kind of the way my philosophy evolved, which was if you see - only maybe one or two times a year do you see something that really, really excites you. And if you look at what excites you and then you look down the road, your record on those particular transactions is far superior to everything else, but the mistake I'd say 98 percent of money managers and individuals make is they feel like they got to be playing in a bunch of stuff. And if you really see it, put all your eggs in one basket and then watch the basket very carefully.”

“…you don't need like 15 stocks or this currency or that. If you see it, you got to go for it because that's a better bet than 90 percent of the other stuff you would add onto it.”

“So, how did I meet George Soros? I was developing a philosophy that if I can look at all these different buckets and I'm going to make concentrated bets, I'd rather have a menu of assets to choose from to make my big bets and particularly since a lot of these assets go up when equities go down, and that's how it was moving.

And then I read The Alchemy of Finance because I'd heard about this guy, Soros. And when I read The Alchemy of Finance, I understood very quickly that he was already employing an advanced version of the philosophy I was developing in my fund. So, when I went over to work for George, my idea was I was going to get my PhD in macro portfolio manager and then leave in a couple years or get fired like the nine predecessors had. But it's funny because I went over there, I thought what I would learn would be like what makes the yen goes up, what makes the deutsche mark move, what makes this, and to my really big surprise, I was as proficient as he was, maybe more so, in predicting trends.

That's not what I learned from George Soros, but I learned something incredibly valuable, and that is when you see it, to bet big. So what I had told you was already evolving, he totally cemented. I know we got a bunch of golfers in the room. For those who follow baseball, I had a higher batting average; Soros had a much bigger slugging percentage. When I took over Quantum, I was running Quantum and Duquesne. He was running his personal account, which was about the size of an institution back then, by the way, and he was focusing 90 percent of his time on philanthropy and not really working day to day. In fact a lot of the time he wasn't even around.

And I'd say 90 percent of the ideas he were [ph.] using came from me, and it was very insightful and I'm a competitive person, frankly embarrassing, that in his personal account working about 10 percent of the time he continued to beat Duquesne and Quantum while I was managing the money. And again it's because he was taking my ideas and he just had more guts. He was betting more money with my ideas than I was.

Probably nothing explains our relationship and what I've learned from him more than the British pound. So, in 1992 in August of that year my housing analyst in Britain called me up and basically said that Britain looked like they were going into a recession because the interest rate increases they were experiencing were causing a downturn in housing. At the same time, if you remember, Germany, the wall had fallen in '89 and they had reunited with East Germany, and because they'd had this disastrous experience with inflation back in the '20s, they were obsessed when the deutsche mark and the [unint.] combined, that they would not have another inflationary experience. So, the Bundesbank, which was getting growth from the [unint.] and had a history of worrying about inflation, was raising rates like crazy. That all sounds normal except the deutsche mark and the British pound were linked. And you cannot have two currencies where one economic outlook is going like this way and the other outlook is going that way.

So, in August of 1 92 there was 7 billion in Quantum. I put a billion and a half, short the British pound based on the thesis I just gave you. So, fast-forward September, next month. I wake up one morning and the head of the Bundesbank, Helmut Schlesinger, has given an editorial in the Financial Times, and I'll skip all the flowers. It basically said the British pound is crap and we don't want to be united with this currency. So, I thought well, this is my opportunity. So, I decided I'm going to bet like Soros bets on the British pound against the deutsche mark.

It just so happens he's in the office. He's usually in Eastern Europe at this time doing his thing. So, I go in at 4:00 and I said, ‘George, I'm going to sell $5.5 billion worth of British pounds tonight and buy deutsche marks. Here's why I'm doing it, that means we'll have 100 percent of the fund in this one trade.’ And as I'm talking, he starts wincing like what is wrong with this kid, and I think he's about to blow away my thesis and he says, ‘That is the most ridiculous use of money management I ever heard. What you described is an incredible one-way bet. We should have 200 percent of our net worth in this trade, not 100 percent. Do you know how often something like this comes around? Like one or 20 years. What is wrong with you?’ So, we started shorting the British pound that night. We didn't get the whole 15 billion on, but we got enough that I'm sure some people in the room have read about it in the financial press.”

Mistakes

“I've thought a lot of things when I'm managing money with great, great conviction, and a lot of times I'm wrong. And when you're betting the ranch and the circumstances change, you have to change, and that's how I've always managed money.”

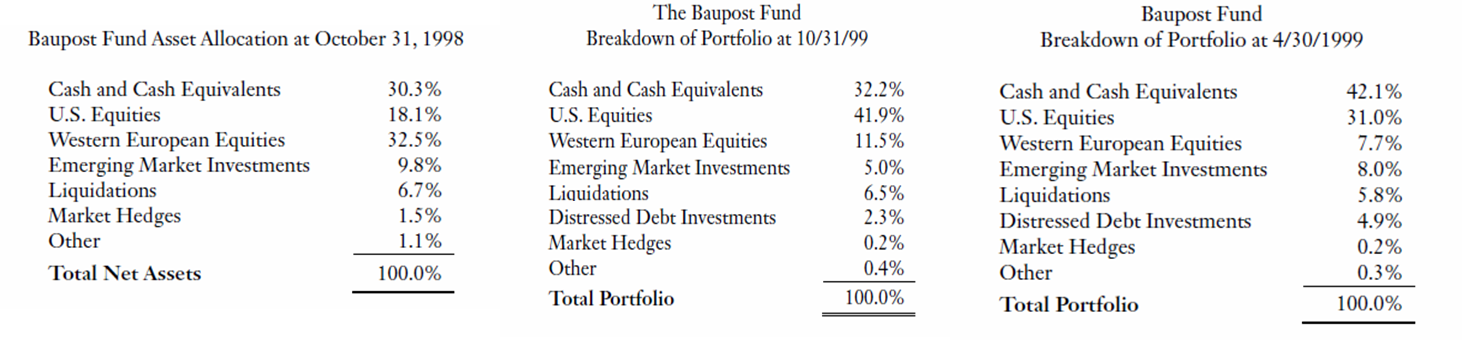

“I made a lot of mistakes, but I made one real doozy. So, this is kind of a funny story, at least it is 15 years later because the pain has subsided a little. But in 1999 after Yahoo and America Online had already gone up like tenfold, I got the bright idea at Soros to short internet stocks. And I put 200 million in them in about February and by mid-march the 200 million short I had lost $600 million on, gotten completely beat up and was down like 15 percent on the year. And I was very proud of the fact that I never had a down year, and I thought well, I'm finished.

So, the next thing that happens is I can't remember whether I went to Silicon Valley or I talked to some 22-year-old with Asperger's. But whoever it was, they convinced me about this new tech boom that was going to take place. So I went and hired a couple of gun slingers because we only knew about IBM and Hewlett-Packard. I needed Veritas and Verisign. I wanted the six. So, we hired this guy and we end up on the year - we had been down 15 and we ended up like 35 percent on the year. And the Nasdaq's gone up 400 percent.

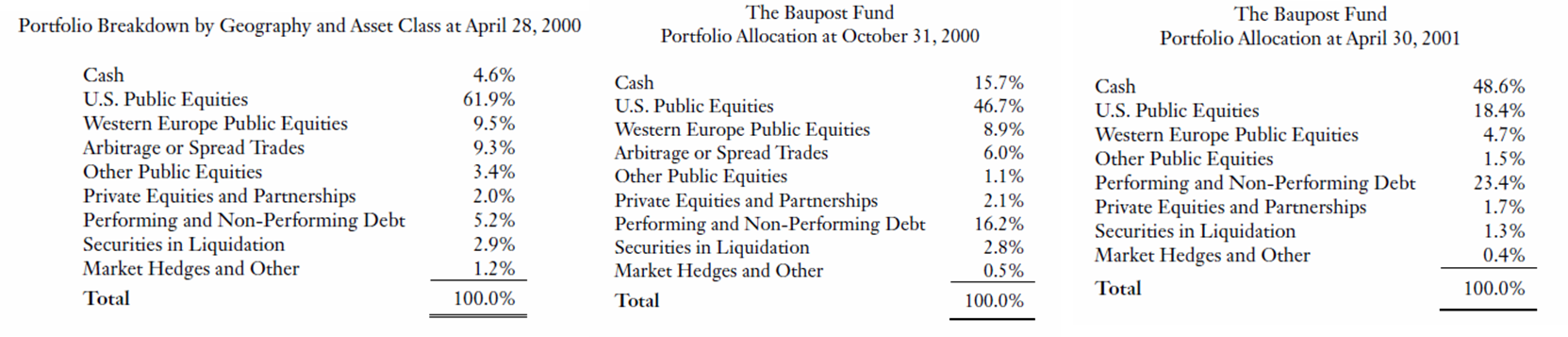

So, I'll never forget it. January of 2000 I go into Soros's office and I say I'm selling all the tech stocks, selling everything. This is crazy. [unint.] at 104 times earnings. This is nuts. Just kind of as I explained earlier, we're going to step aside, wait for the net fat pitch. I didn't fire the two gun slingers. They didn't have enough money to really hurt the fund, but they started making 3 percent a day and I'm out. It is driving me nuts. I mean their little account is like up 50 percent on the year. I think Quantum was up seven. It's just sitting there.

So like around March I could feel it coming. I just - I had to play. I couldn't help myself. And three times during the same week I pick up a - don't do it. Don't do it. Anyway, I pick up the phone finally. I think I missed the top by an hour. I bought $6 billion worth of tech stocks, and in six weeks I had left Soros and I had lost $3 billion in that one play. You asked me what I learned. I didn't learn anything. I already knew that I wasn't supposed to do that. I was just an emotional basket case and couldn't help myself. So, maybe I learned not to do it again, but I already knew that.”

Probably one of the few people in this world who knows what it feels like to lose $3 billion dollars in a single day. For additional reading, please see our previous article titled Mistakes of Boredom.

Psychology

When asked what qualities he looks for in money managers:

“Number one, passion. I mentioned earlier I was passionate about the business. The problem with this business if you're not passionate, it is so invigorating to certain individuals, they're going to work 24/7, and you're competing against them. So, every time you buy something, one of them is selling it. So, if you're with one of the lazy people or one of the people that are just doing it for the money, you're going to get run over by those people.

The other characteristic I like to look for in a money manager is when I look at their record, I immediately go to the bear markets and see how they did. Particularly given sort of the five-year outlook I've given, I want to make sure I've got a money manager who knows how to make money and manage money in turbulent times, not just in bull markets.

The other thing I look for…is open-mindedness and humility. I have never interviewed a money manager who told you he'd never made a mistake, and a lot of them do, who didn't stink. Every great money manager I've ever met, all they want to talk about is their mistakes. There's a great humility there. But and then obviously integrity because passion without integrity leads to jail. So, if you want someone who's absolutely obsessed with the business and obsessed with winning, they're not in it for the money, they're in it for winning, you better have somebody with integrity.”

“If you're early on in your career and they give you a choice between a great mentor or higher pay, take the mentor every time. It's not even close. And don't even think about leaving that mentor until your learning curve peaks. There's just nothing to me so invaluable in my business, but in many businesses, as great mentors. And a lot of kids are just too short-sighted in terms of going for the short-term money instead of preparing themselves for the longer term.”

Liquidity

“…earnings don't move the overall market…focus on the central banks and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It's liquidity that moves markets.”

However, to borrow from Soros’ reasoning within the Alchemy of Finance, one could argue that anticipated earnings influence market participant behavior and therefore influence liquidity.

Other

“…never, ever invest in the present. It doesn't matter what a company's earning, what they have earned. He taught me that you have to visualize the situation 18 months from now, and whatever that is, that's where the price will be, not where it is today…you have to look to the future. If you invest in the present, you're going to get run over.”