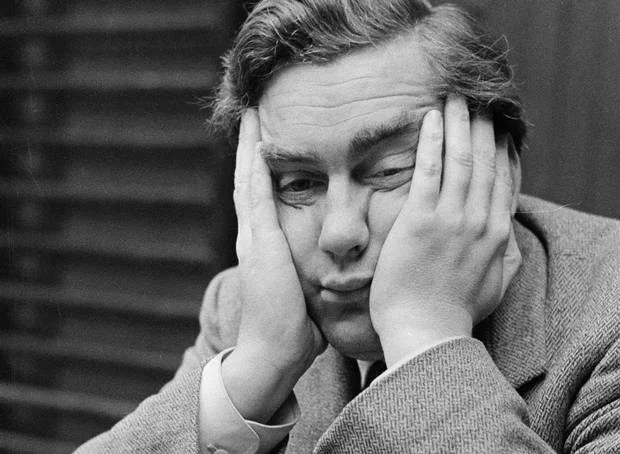

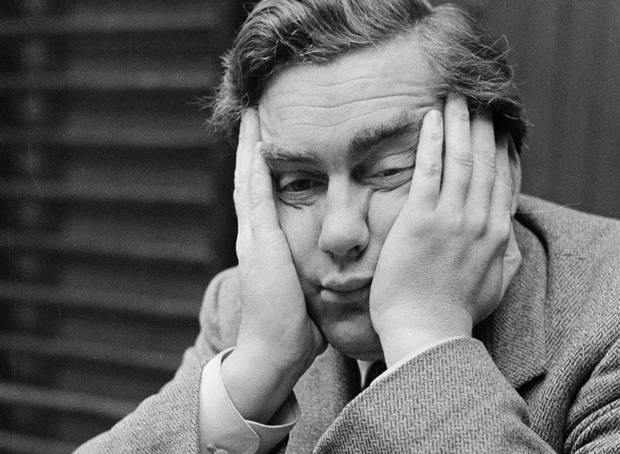

Flying back to Los Angeles after Christmas, somewhere over New Mexico, I rediscovered an article written by Ted Lucas of Lattice Strategies in 2011, quoting mathematician and logician Blaise Pascal’s Pensées on the psychological propensity of humans to seek out diversion and action, and the boredom caused by inaction:

“Sometimes, when I set to thinking about the various activities of men, the dangers and troubles which they face in court, or in war, giving rise to so many quarrels and passions…I have often said that the sole cause of man’s unhappiness is that he does not know how to stay quietly in his room…

Imagine any situation you like, add up all the blessings with which you could be endowed, to be king is still the finest thing in the world; yet if you imagine one with all the advantages to his rank, but no means of diversion, left to ponder and reflect on what he is, this limp felicity will not keep him going…with the result that if he is deprived of so-called diversion he is unhappy, indeed more unhappy than the humblest of subjects who can enjoy sport and diversion.

The only good thing for men therefore is to be diverted from thinking of what they are, either by some occupation which takes their mind off it, or by some novel and agreeable passion which keeps them busy . . . in short it is called diversion.”

If true, as asset prices move ever higher, this psychological tendency has immense implications on investment decisions. Avoiding overvalued assets/securities and holding cash may be easier said than done, for psychological reasons beyond whether or not your mandate/investors allow you to hold cash.

Perhaps it’s time to convince your boss that a paid vacation / sabbatical to pursue distractions (other than investing) during expensive market environments may actually help improve performance returns by avoiding mistakes born of boredom.