Continuation of our series on portfolio management and the Buffett Partnership Letters, please see our previous articles for more details. Historical Performance Analysis, Process Over Outcome, Psychology

“…the workouts (along with controls) saved the day in 1962, and if we had been light in this category that year, our final results would have been much poorer, although still quite respectable considering market conditions during the year…In 1963 we had one sensational workout which greatly influenced results, and generals gave a good account of themselves, resulting in a banner year. If workouts had been normal, (say, more like 1962) we would have looked much poorer compared to the Dow…Finally, in 1964 workouts were a big drag on performance.”

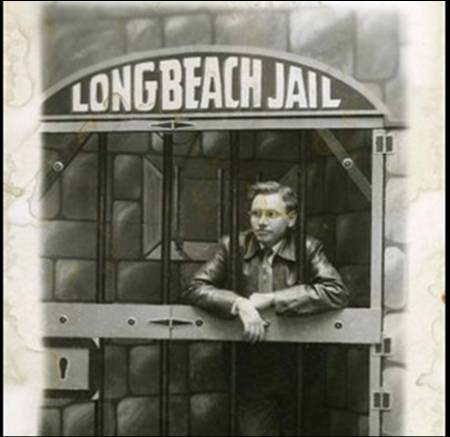

There is a chart in the January 18, 1965 partnership letter, in which Buffett breaks down the performance of Generals vs. Workouts for 1962-1964, and discusses the return attribution of each category in different market environments.

Most investors conduct some form of historical performance review, on a quarterly or annual basis. It’s an important exercise for a variety of reasons:

- To better understand your sources of historical return – performance analysis forces you to examine the relationship between your process vs. the outcome. Was the outcome as expected? If not, do changes need to be made to the process?

- To help you and your team become more self-aware – what you do well, badly, and perhaps reveal patterns of behavioral strength and weakness (here's an article about an interesting firm that offers this analysis)

- Team Compensation

- Highlight necessary adjustment to the portfolio and business

- Etc.

The investment management world spends a lot of time scrutinizing the operations of other businesses. Shouldn’t we apply the same magnifying glass to our own?

Sizing, Catalyst, Hedging, Activism, Control

“What we really like to see in situations like the three mentioned above is a condition where the company is making substantial progress in terms of improving earnings, increasing asset values, etc., but where the market price of the stock is doing very little while we continue to acquire it…Such activity should usually result in either appreciation of market prices from external factors or the acquisition by us of a controlling position in a business at a bargain price. Either alternative suits me.”

“Many times…we have the desirable ‘two strings to our box’ situation where we should either achieve appreciation of market prices from external factors or from the acquisition of control positions in a business at a bargain price. While the former happens in the overwhelming majority of cases, the latter represents an insurance policy most investment operations don’t have.”

Buffett discusses the phenomenon known as the “two strings” on his bow which allowed for heavy concentration in a few positions. The potential to (eventually) acquire a controlling stake in the underlying company served has an “insurance policy” via the creation of a catalyst after asserting control. (Some may argue that activism is applicable here as well. However, we tread cautiously on this train of thought because activism by no means entails a 100% success rate.)

It’s important to understand that control is not an option available to all investors. Therefore, when sizing positions, one should reconsider the exact emulation of Buffett’s enthusiastic buying as price continues to decline, and concentrated approach.

Interestingly, if a controlling stake in a company serves as an insurance policy (as Buffett describes it), is ‘control’ a type of portfolio hedge?

Activism, Control

“We have continued to enlarge the positions in the three companies described in our 1964 midyear report where we are the largest stockholders…It is unlikely that we will ever take a really active part in policy-making in any of these three companies…”

Control ≠ Activism

Conservatism

“To too many people conventionality is indistinguishable from conservatism. In my view, this represents erroneous thinking. Neither a conventional or an unconventional approach, per se, is conservative.”

“Truly conservative actions arise from intelligent hypotheses, correct facts and sound reasoning. These qualities may lead to conventional acts, but there have been many times when they have led to unorthodoxy. In some corner of the world they are probably still holding regular meetings of the Flat Earth Society.”

“We derive no comfort because important people, vocal people, or great numbers of people agree with us. Nor do we derive comfort if they don’t. A public opinion poll is no substitute for thought. When we really sit back with a smile on our face is when we run into a situation we can understand, where the facts are ascertainable and clear, and the course of action obvious. In that case – whether conventional or unconventional – whether others agree or disagree – we feel we are progressing in a conservative manner.”